In-Depth Study on Executive Summary Europe Digital Payment Market Size and Share

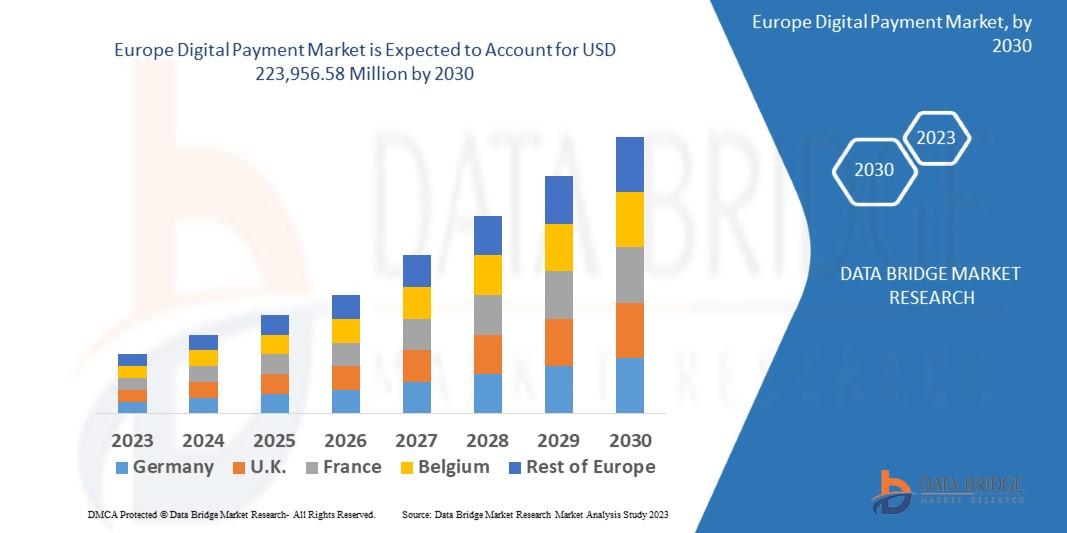

In-Depth Study on Executive Summary Europe Digital Payment Market Size and ShareData Bridge Market Research analyses that the digital payment market is expected to reach USD 223,956.58 million by 2030, which is USD 56,827.44 million in 2022, at a CAGR of 18.70% during the forecast period.

Europe Digital Payment Market research report acts as a very significant constituent of business strategy. This report contains important information which helps to identify and analyze the needs of the market, the market size and the competition with respect to Europe Digital Payment Market industry. This market research report is one of the key factors used in keeping up competitiveness over competitors. When the report goes together with the right tools and technology, it helps deal with a number of uncertain challenges for the business. Europe Digital Payment Market report assists the business to take better decisions for the winning future planning in terms of current and future trends in particular product or the industry.

Europe Digital Payment Market research report deeply analyses the potential of the market with respect to current scenario and the future prospects by taking into view numerous industry aspects. This market report is very helpful for both regular and emerging market player in the Europe Digital Payment Market industry as it provides thorough market insights. The report has been prepared with the experience of skilful and inventive team. Hence the outcome is a great which implies a client-focused, leading edge, and trustworthy market report. Businesses can rely with confidence upon this superior Europe Digital Payment Market report to bring about an utter success.

Uncover strategic insights and future opportunities in the Europe Digital Payment Market. Access the complete report: https://www.databridgemarketresearch.com/reports/europe-digital-payment-market

Europe Digital Payment Market Landscape

**Segments**

- By Component: Payment Gateway, Payment Processing, Payment Acquiring, Payment Security Software, POS Solution, Other Services

- By Deployment Type: On-Premises, Cloud

- By Organization Size: Large Enterprises, Small and Medium-Sized Enterprises (SMEs)

- By End-User: BFSI, Retail, Telecommunication, Healthcare, Government, Transportation, Others

The Europe digital payment market is segmented based on various components, deployment types, organization sizes, and end-users. The component segment includes payment gateway, payment processing, payment acquiring, payment security software, POS solution, and other services. The deployment type segment is categorized into on-premises and cloud-based solutions. In terms of organization size, the market covers large enterprises and small and medium-sized enterprises (SMEs). Furthermore, the end-user segment consists of industries such as BFSI, retail, telecommunication, healthcare, government, transportation, and others, showcasing a diverse landscape for digital payment solutions in Europe.

**Market Players**

- PayPal Holdings, Inc.

- Adyen

- Wirecard

- Worldline

- Ingenico Group

- Stripe

- SumUp

- Paysafe Holdings UK Limited

- Square, Inc.

- Global Payments Inc.

Key market players in the Europe digital payment industry include renowned companies like PayPal Holdings, Inc., Adyen, Wirecard, Worldline, Ingenico Group, Stripe, SumUp, Paysafe Holdings UK Limited, Square, Inc., and Global Payments Inc. These players are actively involved in expanding their market presence through strategic initiatives such as partnerships, acquisitions, product innovations, and technological advancements. Their strong market position, widespread customer base, and focus on delivering efficient and secure digital payment solutions contribute significantly to the growth of the digital payment market in Europe.

Europe's digital payment market is a dynamic ecosystem driven by evolving consumer preferences, technological advancements, regulatory changes, and the competitive landscape. As the adoption of digital payment solutions continues to rise across various industries, market players are strategically positioning themselves to capitalize on this growing trend. The key market players identified in the European digital payment industry are leveraging their expertise and resources to offer innovative products and services that cater to the unique needs of different businesses and consumers.

In the competitive landscape of the Europe digital payment market, companies like PayPal Holdings, Inc., Adyen, Wirecard, Worldline, Ingenico Group, Stripe, SumUp, Paysafe Holdings UK Limited, Square, Inc., and Global Payments Inc. are leading the way in driving innovation and setting industry standards. These players are constantly investing in research and development to enhance their payment solutions, improve transaction security, and streamline the payment process for businesses and consumers alike. By staying at the forefront of technology and market trends, these companies are able to adapt to changing consumer behaviors and regulatory requirements, ensuring their relevance and competitiveness in the market.

Moreover, the Europe digital payment market is witnessing a proliferation of partnerships and collaborations among key players, further intensifying the competitive landscape. By forming strategic alliances, companies are able to leverage each other's strengths, expand their market reach, and offer more comprehensive solutions to their customers. These partnerships also enable companies to stay ahead of the competition in terms of product offerings, customer service, and market penetration. As a result, the European digital payment market is becoming increasingly competitive, with players vying for market share and seeking ways to differentiate themselves in a crowded market.

Additionally, the Europe digital payment market is characterized by a diverse range of end-users, including industries such as BFSI, retail, telecommunication, healthcare, government, transportation, and others. Each of these sectors has unique requirements and challenges when it comes to digital payments, creating opportunities for market players to tailor their solutions to specific industry needs. By understanding the distinct demands of each sector and developing customized payment solutions, companies can gain a competitive edge and establish themselves as leaders in their respective markets.

Overall, the Europe digital payment market presents a dynamic and competitive landscape, driven by innovative solutions, strategic partnerships, and evolving consumer demands. As key players continue to invest in technology and expand their offerings, the market is expected to witness further growth and evolution in the coming years. By staying agile, customer-focused, and proactive in addressing market trends, companies can position themselves for success in this rapidly changing industry.The Europe digital payment market is witnessing significant growth and evolution driven by factors such as changing consumer preferences, technological advancements, and regulatory developments. Key market players like PayPal Holdings, Adyen, Wirecard, and others are playing a crucial role in shaping the competitive landscape through strategic initiatives and innovative product offerings. These companies are focusing on enhancing transaction security, improving payment processing efficiency, and meeting the diverse needs of businesses and consumers across different industries.

One of the key trends in the Europe digital payment market is the increasing adoption of cloud-based solutions, which offer scalability, flexibility, and cost-effectiveness for businesses of all sizes. As more organizations shift towards cloud deployment models, there is a growing demand for seamless integration with existing systems and robust payment security features. Market players are responding to this trend by investing in cloud-based technologies and offering tailored solutions to meet the unique requirements of various industries.

Another important aspect of the Europe digital payment market is the emphasis on collaboration and partnerships among key players. By forming strategic alliances, companies can leverage their strengths, expand their market presence, and enhance their product portfolios. These partnerships not only drive innovation and technological advancement but also enable companies to deliver more comprehensive and integrated payment solutions to their customers. Through strategic collaborations, market players can drive growth, improve customer satisfaction, and stay ahead of the competition in a rapidly evolving market.

Furthermore, the diverse range of end-users in the Europe digital payment market presents both opportunities and challenges for market players. Different industries such as BFSI, retail, healthcare, and government have unique payment processing requirements and regulatory compliance standards. Market players need to tailor their solutions to address these specific needs and provide seamless payment experiences for businesses and consumers operating in different sectors. This industry-specific approach enables companies to establish themselves as trusted partners and industry leaders, driving customer loyalty and market differentiation.

In conclusion, the Europe digital payment market is a dynamic and competitive landscape characterized by innovation, strategic partnerships, and evolving consumer demands. Key players in the market are continuously investing in technology, product development, and market expansion to stay ahead of the curve and drive growth. By focusing on customer-centric solutions, industry collaboration, and tailored offerings for diverse end-users, companies can position themselves for success in this rapidly evolving market.

View comprehensive company market share data

https://www.databridgemarketresearch.com/reports/europe-digital-payment-market/companies

Global Europe Digital Payment Market: Strategic Question Framework

- What is the historical size of the Europe Digital Payment Market?

- What are the future projections for Europe Digital Payment Market expansion?

- How is the Europe Digital Payment Market segmented by product type?

- What are the latest acquisitions in this market?

- Which companies are investing heavily in R&D?

- What environmental factors are influencing Europe Digital Payment Market dynamics?

- What are the consumer preferences in key regions?

- What market entry strategies are most effective?

- How fragmented or consolidated is the Europe Digital Payment Market?

- What pricing trends are observed across regions?

- Which segment is forecasted to grow the fastest in Europe Digital Payment Market?

- How do government policies affect the Europe Digital Payment Market?

- What is the Europe Digital Payment Market outlook for the next decade?

- How resilient is the market to global Europe Digital Payment Marketdisruptions?

Browse More Reports:

North America Electrosurgery Equipment Market

Middle East and Africa Electrosurgery Equipment Market

Asia-Pacific Operating Room Equipment Supplies Market

Europe Operating Room Equipment Supplies Market

Middle East and Africa Operating Room Equipment Supplies Market

North America Operating Room Equipment Supplies Market

Latin America Pen Needles Market

Asia-Pacific Pen Needles Market

Europe Pen Needles Market

Middle East and Africa Pen Needles Market

North America Pen Needles Market

Asia-Pacific Spunbond Market

Europe Spunbond Market

Middle East and Africa Spunbond Market

North America Spunbond Market

Global Healthcare Personal Protective Equipment Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- [email protected]